abhaz-uzel.ru

Market

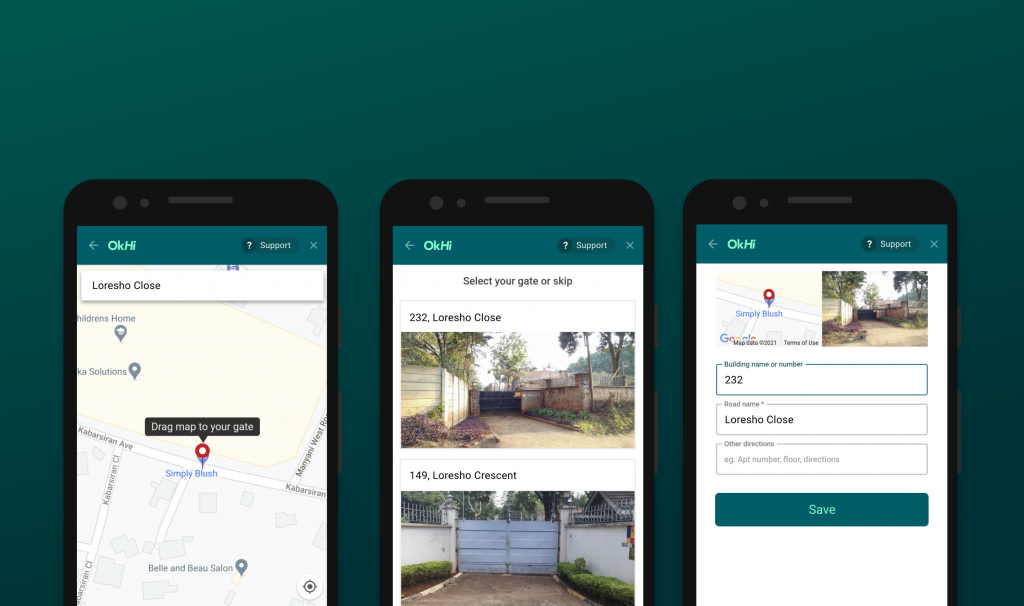

Smart Street Address Validation

Address validation is the process of making sure that an address is accurate, complete, and correctly formatted according to postal records. Postal address verification. Keep your data fresh and reduce returns. Verify Smart Business Reports · Contact Us · Legal Terms & Conditions · Privacy. Smarty Address Validation (formerly SmartyStreets) looks up the shipping address entered by your customer and attempts to verify that it is the correct address. address: residential, PO Box, or business. This property might not be populated for every address processed by the Address Validation API, but indicates if. Address verification tools aim to verify, correct, and standardize residential and corporate addresses and other physical identifying data. Free address verification tools are the software solutions that check and confirm the accuracy of postal addresses. Informatica's Address Verification is the only service that combines postal certifications in one engine from all six global postal organizations. Melissa's address verification systems standardize your US, Canada and International postal addresses – CASS and SERP Certified. The Address Validation API is a smart solution to resolve inaccurate contact details and enable faster delivery of packages with precision. Address validation is the process of making sure that an address is accurate, complete, and correctly formatted according to postal records. Postal address verification. Keep your data fresh and reduce returns. Verify Smart Business Reports · Contact Us · Legal Terms & Conditions · Privacy. Smarty Address Validation (formerly SmartyStreets) looks up the shipping address entered by your customer and attempts to verify that it is the correct address. address: residential, PO Box, or business. This property might not be populated for every address processed by the Address Validation API, but indicates if. Address verification tools aim to verify, correct, and standardize residential and corporate addresses and other physical identifying data. Free address verification tools are the software solutions that check and confirm the accuracy of postal addresses. Informatica's Address Verification is the only service that combines postal certifications in one engine from all six global postal organizations. Melissa's address verification systems standardize your US, Canada and International postal addresses – CASS and SERP Certified. The Address Validation API is a smart solution to resolve inaccurate contact details and enable faster delivery of packages with precision.

Address verification can be used in real time to verify mailing addresses or to provide type-ahead smart data when entering addresses. It can also be used. Smarty is an address verification tool you can add to your form to automatically check and verify addresses that your users enter into your form. This. mailing address validation? In our web application, we have a form that asks for a mailing address and we need to ensure that it is a valid. In as few as three keystrokes and as quickly as milliseconds, our technology will suggest complete and precise locations anywhere in the world. Works in any. Secure the benefits of real-time postal address validation across all business-critical systems, databases and applications or desktop systems. Smart Coupons · Cashier for WooCommerce · Affiliate For WooCommerce · Mix and ↑ Back to top Postcode lookup, address auto-complete, or address verification. Smart address validation Your highest delivery rate. Having Foxentry on your website means that even incomplete addresses full of errors won't need human. Type Ahead: Capture the right address in real time with smart auto complete features. validating them to external postal data sources and enhancing addresses. home/Address validation/Experian Address Validation/Address API reference/Validate Indicates whether selected address is a Post Office Box Street Address, a. Address Complete · Home; Learn More. Overview · Try Now · Simple Setup · Data · Pricing It enables intelligent and rapid searching to increase accuracy and. Our address validation software cleanses, corrects and standardizes address data before mailing. The software is designed to overcome wide variations in. Postal Address Validation Software. Postal address validation helps to ensure postal address references in your customer database are up to date and accurate. I have a form with which I am using Smarty Streets Live Address validation. Form validation with smart wizard · 0 · jQuery Smart Wizard v4. Improve data quality by capturing correct UK addresses. Boost conversions and user experience with postcode address verification and geocoding technology. Shipping address validation or shipping address verification confirms whether the street and its postal addresses exist. How can Smart Packaging. Cool Data. Address Customization. Smarty Streets Setup. Overview · Reviews · More Details. Highlights. Instant address verification +auto complete + geocoding. Geoapify's Geocoding API accepts a whole address or its components such as postcode, city, street, or house number. You can set your own parameters such as. The Address Validation Street Level API can be used to check addresses v1. pickuptype. required. string >= 1. Type of pickup. Valid values: oncall smart both. Address Management provides value added product and service offerings that enable United States Postal Service business customers to better manage the quality. World champion of location data intelligence. Our APIs verify, validate, enrich, standardize, geocode, and auto-complete addresses at blazing speed.

Earn Crypto Watching Youtube

Whether you're seeking to supplement your income or simply enjoy watching videos, JumpTask ensures fair compensation for your time and efforts, making it a. Watching a video about a new Web3 project helps to educate users, while at the same time providing a way to earn free tokens. It is a way to learn about crypto. This article will browse some real opportunities to earn not a fortune but some coins in your wallet by watching videos. Making money from YouTube used to be as simple as uploading great content, garnering millions of views, and earning a share of advertising revenue. Check out our top picks of the best cryptocurrency YouTube channels in that offer insight & expert opinion. Don't waste time with bad crypto YouTubers. Some exchanges offer cryptocurrency rewards to users who watch educational content about the cryptocurrency ecosystem. Here are some platforms that offer Learn. Wondering how to make money with Bitcoin? Want to earn cryptocurrency for watching videos? Being paid in crypto just for learning about it can sound too good to. Want to earn cryptocurrency without investing anything? Well, you can now do just that by watching videos. Yes, you read that right. In addition to watching content everyday and receiving the Daily Watch Reward, we can also earn LBC by posting content and gaining views, gaining followers. Whether you're seeking to supplement your income or simply enjoy watching videos, JumpTask ensures fair compensation for your time and efforts, making it a. Watching a video about a new Web3 project helps to educate users, while at the same time providing a way to earn free tokens. It is a way to learn about crypto. This article will browse some real opportunities to earn not a fortune but some coins in your wallet by watching videos. Making money from YouTube used to be as simple as uploading great content, garnering millions of views, and earning a share of advertising revenue. Check out our top picks of the best cryptocurrency YouTube channels in that offer insight & expert opinion. Don't waste time with bad crypto YouTubers. Some exchanges offer cryptocurrency rewards to users who watch educational content about the cryptocurrency ecosystem. Here are some platforms that offer Learn. Wondering how to make money with Bitcoin? Want to earn cryptocurrency for watching videos? Being paid in crypto just for learning about it can sound too good to. Want to earn cryptocurrency without investing anything? Well, you can now do just that by watching videos. Yes, you read that right. In addition to watching content everyday and receiving the Daily Watch Reward, we can also earn LBC by posting content and gaining views, gaining followers.

Yes, there are platforms that reward users with small amounts of Bitcoin for playing games or watching videos. However, be cautious, as some. crypto exchange which lists VRA tokens or spend your VRA balance on EARN $ Every 3 Mins Watching Youtube Videos | Make Money Online Discover FRAK, the Defi protocol for earning money by watching YouTube videos! FRAK rewards you for every minute you spend watching videos on YouTube. Earn crypto and cash for watching videos and movies online by nobel You can earn money by watching YouTube videos and ads through platforms like Swagbucks, InboxDollars, and MyPoints. These sites pay users to. Unlike the previous two, personal finance channels focus less on earning money by hustling and improving your marketing. Instead, they show you how to manage –. watch videos on YouTube, and you will still be able to earn. So get paid in cryptocurrency like DOGE, DASH, Bitcoin, or LiteCoin. So, you. Welcome to our channel! In this exciting video, we reveal a unique opportunity to earn $ worth of free Bitcoin by simply watching videos. Swagbucks. Swagbucks is one of the most popular rewards websites that pay you for watching videos, among other tasks. You can earn “SB points”. 4 Making videos that people will actively watch until the end will earn you more than a video where people click away after only a few seconds. Other YouTube. Hey guys, I am kinda new on Reddit. I am just looking for some fun. Does anybody know a legitimate watch and earn platform to earn crypto? There are multiple ways to earn LBC, but the most common and sure-fire daily way is to view at least one video once a day. Just create a crypto donation page on your website and link to it from an info card and watch the coins roll in. Share your crypto donation link on the. Various apps like Swagbucks, InboxDollars, Irazoo App, PrizeRebel, MyPoints, and Nielsen Computer and Mobile allow you to watch videos and earn money. All of. Where to Get Paid to Watch YouTube Videos · Nielsen Computer & Mobile Panel · Swagbucks · Paidwork · InstaCG · Other Opportunities to Make Money. Earn and learn crypto in a fun way. Earn free crypto by watching videos. Get free crypto or trading bonuses while learning about crypto today at Phemex. I just got the one about earning money for watching videos, which is obviously bs. If you could become a multi-millionaire watching YouTube. TV-TWO is the best of all rewards apps. You simply watch the videos you love and earn crypto while doing so. I am just looking for some fun. Does anybody know a legitimate watch and earn platform to earn crypto? I don't mind referral links. You can earn free crypto on Coinbase through Coinbase Earn just by watching a few videos about crypto and finishing a short quiz. Youtube.

Fxcm Brokerage

Trade & invest with FXCM. Reviews by verified customers, latest terms & conditions for accounts, research ideas & scripts posted by brokers. Start trading with No. 1 forex broker in the US*. Our award-winning online forex trading platforms and apps are available on web, desktop and mobile. FXCM Pro leverages FXCM's scale, technology and relationships to offer trading solutions to retail brokers, hedge funds and emerging market banks. About this app. arrow_forward. FXCM Trading Station Mobile offers you powerful trading tools in the palm of your hand. We launched a brand new app. It allows. Explore our FXCM Apps 1 and customize your trading experience with Standalone or Trading Station apps that just make trading smoother. FXCM has established a strong global presence, catering to traders from various regions worldwide. With a long-standing reputation in the. Learn how to open an account with FXCM in 3 easy steps. Start trading forex, stock and currency indices, commodities and cryptocurrencies! FXCM is a reputable forex broker that can be a good choice for beginners. They offer user-friendly platforms, educational resources, and. At FXCM, opening a live forex trading account is quick and easy. All you need to do is confirm your country of residence and complete the online application. Trade & invest with FXCM. Reviews by verified customers, latest terms & conditions for accounts, research ideas & scripts posted by brokers. Start trading with No. 1 forex broker in the US*. Our award-winning online forex trading platforms and apps are available on web, desktop and mobile. FXCM Pro leverages FXCM's scale, technology and relationships to offer trading solutions to retail brokers, hedge funds and emerging market banks. About this app. arrow_forward. FXCM Trading Station Mobile offers you powerful trading tools in the palm of your hand. We launched a brand new app. It allows. Explore our FXCM Apps 1 and customize your trading experience with Standalone or Trading Station apps that just make trading smoother. FXCM has established a strong global presence, catering to traders from various regions worldwide. With a long-standing reputation in the. Learn how to open an account with FXCM in 3 easy steps. Start trading forex, stock and currency indices, commodities and cryptocurrencies! FXCM is a reputable forex broker that can be a good choice for beginners. They offer user-friendly platforms, educational resources, and. At FXCM, opening a live forex trading account is quick and easy. All you need to do is confirm your country of residence and complete the online application.

I'm looking to trade with FXCM / FX Capital Markets but noticed a story in the Times in January which detailed a dispute the company was involved in with a. Forex traders can also trade using several trading platforms: MetaTrader, Trading Station, ZuluTrade, and even TradingView. However, this broker has had legal. FXCM is a leading online forex trading and CFD broker. Sign up for a risk-free demo account and trade forex 24/5. Detailed review of the FXCM forex broker. Quick insight into their financial services, trading conditions, payment options, registered location and more. FXCM, also known as Forex Capital Markets, is a retail foreign exchange broker for trading on the foreign exchange market. We'll break down the essential concepts and guide you through the most critical steps, from choosing a broker and placing your first trade to developing a. CFD Trading with FXCM. CFD trading allows you to trade the price movements of currency, stock indices and commodities like gold and oil without buying the. They are worse than anything you can ever imagine, what they did to ATC Broker was wrong, unethical and disloyal, these guys are money hungry wolfs. The FXCM Trading Station platform is available for desktops, in web format for Macs, and for mobile devices. It is a powerful platform and mobile users benefit. FXCM is a leading online forex trading and CFD broker in Malaysia & South-East-Asia. Sign up for a risk-free demo account and trade forex 24/5. When you open a trade with FXCM, the cost you pay is the spread. The spread is the difference between the BUY and SELL prices. FXCM: As of June , there is in excess of $ million in customer funds trading on platforms offered by FXCM. Over live accounts trade through. Stock analysis for Global Brokerage Inc (FXCM:US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Let me give you the rundown on FXCM. Now, FXCM, for those not in the know, is a well-established Forex brokerage. The question to ask here is is meta-trader displaying the "correct price" or is FXCM? Looking at the way the FX market works, being over the counter, looking. FXCM is a UK-based broker offering forex and CFD trading. FXCM's account opening process is straightforward, easy and fast. It has great technical research. FXCM Broker has solidified its reputation as a trusted and experienced brokerage firm, catering to traders of all levels, from novices to seasoned. FXCM is a leading provider of online foreign exchange (FX) trading, CFD trading and related services. Trading With FXCM; Global Broker · International Offices. Why Trade Shares with FXCM? · Extended Hours Trading – US Shares (24 Hours). Trade pre-, post-, and overnight markets for selected popular US Shares, including. FXCM The broker's trading platform is easy to understand and its customer support is abhaz-uzel.ru has the best software in the trading world. Do not use their.

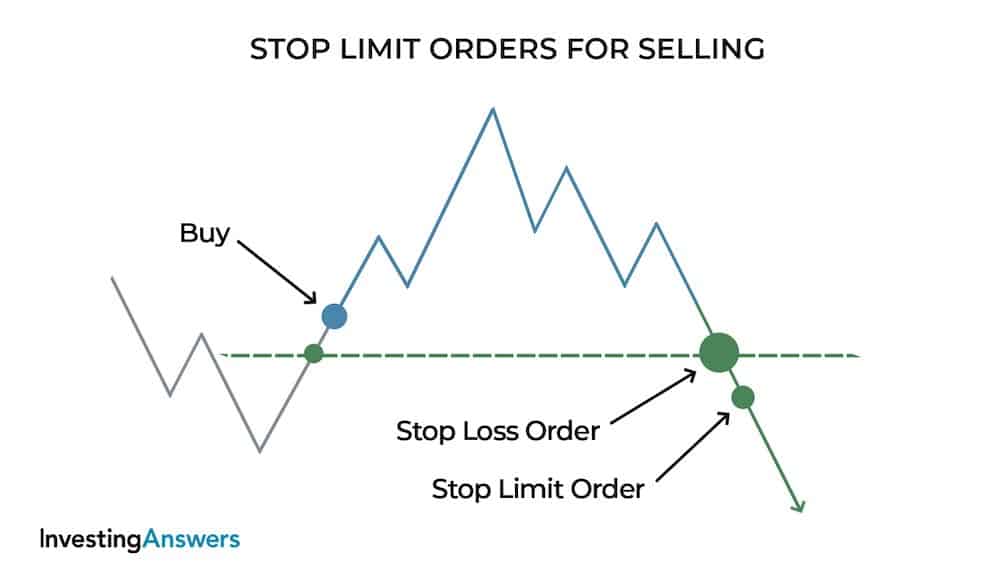

Limit Selling Stock

Sell stop order: This type of order can help limit your losses if a stock you own falls more than you'd like. When triggered, the order becomes a market order. The order means you'll sell shares at the market — no matter what the price is. The trading volume on this stock is thin There aren't many current bids. A limit order is an order to buy or sell a certain security for a specific price or better. For instance, if you wanted to purchase shares of a $ stock at. Your limit sell order tells the market you are willing to sell your shares for $99, even though people are willing to pay $ for them. Your shares will. Understanding limit sells · Instead of watching the market and hoping that the stock rises above $, you place a limit sell on stock XYZ for $ · This means. A limit order might be used when you want to buy or sell at a specific price. If you are concerned about risks to the market, one action you can take is to. A limit order ensures that you get a price for a stock or an ETF in the range you set—the maximum you're willing to pay or the minimum you're willing to accept. A limit order allows investors to buy or sell securities at a price they set or better. Learn how limit orders can help your trading strategy. A limit order is an order to buy or sell a security at a specific price. A buy limit order can only be executed at the limit price or lower. Sell stop order: This type of order can help limit your losses if a stock you own falls more than you'd like. When triggered, the order becomes a market order. The order means you'll sell shares at the market — no matter what the price is. The trading volume on this stock is thin There aren't many current bids. A limit order is an order to buy or sell a certain security for a specific price or better. For instance, if you wanted to purchase shares of a $ stock at. Your limit sell order tells the market you are willing to sell your shares for $99, even though people are willing to pay $ for them. Your shares will. Understanding limit sells · Instead of watching the market and hoping that the stock rises above $, you place a limit sell on stock XYZ for $ · This means. A limit order might be used when you want to buy or sell at a specific price. If you are concerned about risks to the market, one action you can take is to. A limit order ensures that you get a price for a stock or an ETF in the range you set—the maximum you're willing to pay or the minimum you're willing to accept. A limit order allows investors to buy or sell securities at a price they set or better. Learn how limit orders can help your trading strategy. A limit order is an order to buy or sell a security at a specific price. A buy limit order can only be executed at the limit price or lower.

Limit orders similarly allow you to set a desired price range for the sale of shares you own. If the stock never reaches that price range while your order is in. A limit order allows investors to purchase or sell a stock at a specified price or better. In case of buy limit orders, the order will only get executed below. Yes, you can place a limit order to buy or sell a stock that is already trading at your limit price. I routinely place limit orders slightly. One to sell if it climbs to a certain price (up) and one to sell if the stock dips to a certain price (down) I tried using a stop limit. A limit order is an order to either buy stock at a designated maximum price per share or sell stock at a minimum price share. So a limit order at $50 would be placed when the stock is trading at lower than $50, and the instruction to the broker is Sell this stock when the price reaches. Such a limit will facilitate the automatic purchase or sale of stock at a desirable price. Setting this limit order protects you from selling your shares of X. A limit order is an instruction for a broker to buy a stock or other security at or below a set price, or to sell a stock at or above the indicated price. A limit order is an instruction for a broker to buy a stock or other security at or below a set price, or to sell a stock at or above the indicated price. A limit order is the worst price you are willing to sell the shares for. E.g. I want to sell shares for (my limit) amount or better. A. Sell stop loss and sell stop limit orders must be entered at a price which is below the current market price. A sell stop limit is a conditional order to a broker to sell the stock when its price falls up to a specific price – i.e., stop price. A sell stop price has two. Step 1 – Enter a Limit Sell Order. You're long shares of XYZ stock at an Average Price of (your entry price). You want to make a profit of. A limit order in financial markets is an instruction to buy or sell a stock or other security at a specified price. A limit order allows investors to purchase or sell a stock at a specified price or better. In case of buy limit orders, the order will only get executed below. This strategic approach allows you to avoid selling your shares at a larger potential loss if the stock's price experiences a sudden drop because shares will. A limit order is an order to buy or sell a stock at a specific price or better. A buy limit order can only be executed at the limit price or lower. You're long shares of XYZ stock at an Average Price of (your entry price). You want to sell those shares but you want to limit your loss to. What is a limit order? In contrast, limit orders are used to buy or sell stocks at a specific price or better, guaranteeing you'll get a minimum execution. Some securities can only be bought or sold through a market/limit order because they are not window-tradable securities, meaning they cannot be traded in a.

Bny Mellon Money Market Funds

The fund normally invests at least 80% of its net assets in short-term, high-quality municipal obligations that provide income exempt from federal income tax. Full Array of Money Market Funds and Select Offshore Liquidity Funds BNYMIM EMEA, BNY MFML or the BNY Mellon funds. The value of investments can. The fund normally invests in a diversified portfolio of high-quality, short-term, US-dollar-denominated debt securities. Get MOMXX mutual fund information for BNY-Mellon-Funds-Trust-National-Municipal-Money-Market-Fund-Class-M, including a fund overview,, Morningstar summary. See BNY Mellon Short Term US Govt Sec Fund (MISTX) mutual fund ratings from all the top fund analysts in one place. See BNY Mellon Short Term US Govt Sec. Fund Details. Legal Name. BNY Mellon Government Money Market Fund. Fund Family Name. BNY Mellon Funds. Inception Date. May 09, Shares Outstanding. N/A. 13 money market funds. · A full range of pricing options with multiple share classes available within each fund. · Our parent company is BNY Mellon. The fund normally invests at least 80% of its net assets in government securities and repurchase agreements collateralized solely by government securities. The fund is a government money market fund managed to meet the requirements of Rule 2A-7 under the Investment Company Act of Total Fund Assets. The fund normally invests at least 80% of its net assets in short-term, high-quality municipal obligations that provide income exempt from federal income tax. Full Array of Money Market Funds and Select Offshore Liquidity Funds BNYMIM EMEA, BNY MFML or the BNY Mellon funds. The value of investments can. The fund normally invests in a diversified portfolio of high-quality, short-term, US-dollar-denominated debt securities. Get MOMXX mutual fund information for BNY-Mellon-Funds-Trust-National-Municipal-Money-Market-Fund-Class-M, including a fund overview,, Morningstar summary. See BNY Mellon Short Term US Govt Sec Fund (MISTX) mutual fund ratings from all the top fund analysts in one place. See BNY Mellon Short Term US Govt Sec. Fund Details. Legal Name. BNY Mellon Government Money Market Fund. Fund Family Name. BNY Mellon Funds. Inception Date. May 09, Shares Outstanding. N/A. 13 money market funds. · A full range of pricing options with multiple share classes available within each fund. · Our parent company is BNY Mellon. The fund normally invests at least 80% of its net assets in government securities and repurchase agreements collateralized solely by government securities. The fund is a government money market fund managed to meet the requirements of Rule 2A-7 under the Investment Company Act of Total Fund Assets.

Find the latest performance data chart, historical data and news for BNY Mellon Government Money Market Fund - Class M (MLMXX) at abhaz-uzel.ru Get BNY Mellon Government Money Market Fund Class M (MLMXX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Open an Account. Invest in everything from stocks and bonds to mutual funds, ETFs, and more. Open a brokerage account. BNYMIM EMEA, BNY MFML or the BNY Mellon funds. Portfolio holdings are An investment in a money market fund is not a guaranteed investment; it is. A complete solution for money market funds to manage liquidity, credit and settlement processes. The solution's real-time cash management and end-to-end. Insight managed funds are distributed to retail investors by BNY Mellon Investment Management. If you are an individual investor who has been approached to. MLOXX | A complete BNY Mellon Government Money Market Fund;Investor mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and. MLMXX | A complete BNY Mellon Government Money Market Fund;M mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and mutual fund. BNY Mellon Variable Investment Fund Government Money Market Portfolio ; Manager & start date. Management Team. ; Cash, % ; US bond, % ; US. the Money Market Fund Regulation (MMFR) and a sub-fund of BNY Mellon Investors are unlikely to face a financial loss should BNY Mellon Fund Management . The BNY Mellon Liquidity Funds are available in two U.S. dollar denominated money funds; BNY Mellon U.S. Dollar Liquidity Fund and BNY Mellon U.S. Treasury Fund. Money market fund shares are not a deposit or obligation of BNY Mellon. Investments in money market funds are not insured, guaranteed, recommended or. Securities instruments and services other than money market mutual funds and off-shore liquidity funds are offered by BNY Mellon Capital Markets, LLC and The. Funds in your Brex business account that you choose to store in money market funds are segregated and held by Bank of New York Mellon. government. UNDERLYING MANAGER'S. INFORMATION. BNY Mellon Money Market Fund. INPRS Manager Inception Date: August LOW. MODERATE. HIGH. Updated as of: 6/ Find the latest BNY Mellon Funds Trust - BNY Mellon Money Market Fund (MLMXX) stock quote, history, news and other vital information to help you with your. The fund is a government money market fund managed to meet the requirements of Rule 2A-7 under the Investment Company Act of Total Fund Assets. BNY Mellon Funds ; Dreyfus Treasury and Agency Liquidity Money Market Fund. DTLXX · $ % ; BNY Mellon S&P Index Fund. PEOPX · $ +% ; BNY Mellon. Maximize the Investment Value of Idle Funds · Repurchase agreements · Money market mutual funds · Overnight Eurodollar time deposits. Find the latest BNY Mellon Funds Trust - BNY Mellon Money Market Fund (MLOXX) stock quote, history, news and other vital information to help you with your.

How Is Net Asset Value Calculated

NAV stands for 'Net Asset Value.' NAV represents the price at which a mutual fund may be bought by an investor or sold back to a fund house. The NAV formula is simply the total value of a fund's assets minus the total value of its liabilities. This calculation provides a snapshot of a fund's overall. Net asset value is the value of a fund's assets minus any liabilities and expenses. The NAV (on a per-share basis) represents the price. NAV is a financial metric used to determine the value of an investment fund, such as a mutual fund, exchange-traded fund (ETF), or closed-end fund. NAV stands for Net Asset Value. It is the value of one unit of the mutual fund. The NAV of a mutual fund is calculated based on the closing price of all assets. It is calculated by subtracting the total liabilities of the fund from its total assets and then dividing this result by the number of outstanding units. Let's take a closer look at NAV, how it is used, and how it will relate to the Yieldstreet Prism Fund. How is NAV determined? NAV is determined by dividing the. Every period and usually minimum once per year, the Fund Administrator is required to calculate the NAV per share. The manager of the Mutual Fund then. Calculating NAVs · Taking the current market value of its total assets · Subtracting any liabilities · Dividing that amount by the total number of shares owned by. NAV stands for 'Net Asset Value.' NAV represents the price at which a mutual fund may be bought by an investor or sold back to a fund house. The NAV formula is simply the total value of a fund's assets minus the total value of its liabilities. This calculation provides a snapshot of a fund's overall. Net asset value is the value of a fund's assets minus any liabilities and expenses. The NAV (on a per-share basis) represents the price. NAV is a financial metric used to determine the value of an investment fund, such as a mutual fund, exchange-traded fund (ETF), or closed-end fund. NAV stands for Net Asset Value. It is the value of one unit of the mutual fund. The NAV of a mutual fund is calculated based on the closing price of all assets. It is calculated by subtracting the total liabilities of the fund from its total assets and then dividing this result by the number of outstanding units. Let's take a closer look at NAV, how it is used, and how it will relate to the Yieldstreet Prism Fund. How is NAV determined? NAV is determined by dividing the. Every period and usually minimum once per year, the Fund Administrator is required to calculate the NAV per share. The manager of the Mutual Fund then. Calculating NAVs · Taking the current market value of its total assets · Subtracting any liabilities · Dividing that amount by the total number of shares owned by.

NAV is the per unit value of a Mutual Fund or an Exchange-Traded Fund (ETF). Think of it as the price at which you can buy or sell a unit of a Mutual Fund. It. Net Asset Value The net asset value formula is used to calculate a mutual fund's value per share. A mutual fund is a pool of investments that are divided into. Net asset value (NAV) represents a fund's per share market value. Let us understand the NAV calculation and how to calculate NAV of a mutual fund. Read now! For a mutual fund's per-share NAV: We take the value of its assets (stocks, bonds, and cash), subtract its liabilities (expenses), and divide by the total. "Net asset value," or "NAV," of an investment company is the company's total assets minus its total liabilities. For example, if an investment company has. To ensure the same, a notional value is assigned to every individual mutual fund unit and then the number of units held by each investor is estimated. This. The basic formula to calculate NAV is straightforward: NAV = (Total Value of Assets - Total Liabilities) / Number of Shares Outstanding. Let's break down this. In the NAV calculation, the value of each asset is calculated using actual NOI multiplied by an estimate of the market cap rate. If the REIT's actual stock. It is a fundamental metric used to assess the value of a mutual fund. It represents the per-unit value of the fund's assets after deducting any liabilities. The calculation of NAV is intended to be a calculation of the fair value of the Company's assets less the. Company's outstanding liabilities as described below. NAV - Net Asset Value represents the market value per share for a particular mutual fund. It is calculated by deducting the liabilities from total asset. A fund's NAV is the sum of all its assets (the value of its holdings in cash, shares, bonds, financial derivatives and other securities) less any liabilities. Net Asset Value The net asset value formula is used to calculate a mutual fund's value per share. A mutual fund is a pool of investments that are divided into. - NAV measures the value of an investment fund. - It is calculated by subtracting the fund's liabilities from its assets and dividing by the number of shares. -. NAV is typically used to represent the value of the fund per share, however, so the total above is usually divided by the number of outstanding shares. This. NAVPS is a metric used to assess the value of a real estate investment trust (REIT), and it indicates the worth of one share of a mutual fund or exchange-. For example, the net asset value of a managed fund or exchange-traded fund per unit would be calculated by subtracting the fund's liabilities from the. If you want to know the net asset value meaning, just think of it as the latest market price of each unit of the mutual fund scheme. How to calculate NAV of. For example, if the market value of securities of a mutual fund scheme is ₹ lakh and the mutual fund has issued 10 lakh units of ₹ 10 each to the investors. A fund's NAV is the sum of all its assets (the value of its holdings in cash, shares, bonds, financial derivatives, and other securities) less any liabilities.

Look Up Stocks By Price

Google Finance provides real-time market quotes, international exchanges, up-to-date financial news, and analytics to help you make more informed trading. Speculation that the Fed may cut interest rates by 50 bp at next week's FOMC meeting supported stocks Friday after former New York Fed President Dudley said. Stock Price Performance · Stock Quote · Stock Chart · Stock Quote · Stock Chart · Historical Price Lookup · WEEK OF September 9, · Historical Share Prices Prior. An overview of all the stock ticker symbols listed. Explore the stock pages to learn about the company's price history, financials, key stats, and more. The chart shows company stock prices from begin year to present. The Look Up. Stock Quote: NYSE: ONON. Day's Open. $ Volume. 5,, Intraday. Use the tabs to find data on Price, Performance over a variety of time periods, Technical analysis summaries and key Fundamental information. During earnings. Yahoo Finance Screeners lets you choose from hundreds of data filters to discover Stocks, Mutual Funds, ETFs and more. Year End Stock Prices The historical stock information provided is for informational purposes only and is not intended for trading purposes. The historical. U.S. STOCKS ; Nasdaq Composite, , ; S&P , , ; DJ Total Stock Market, , ; Russell , , Google Finance provides real-time market quotes, international exchanges, up-to-date financial news, and analytics to help you make more informed trading. Speculation that the Fed may cut interest rates by 50 bp at next week's FOMC meeting supported stocks Friday after former New York Fed President Dudley said. Stock Price Performance · Stock Quote · Stock Chart · Stock Quote · Stock Chart · Historical Price Lookup · WEEK OF September 9, · Historical Share Prices Prior. An overview of all the stock ticker symbols listed. Explore the stock pages to learn about the company's price history, financials, key stats, and more. The chart shows company stock prices from begin year to present. The Look Up. Stock Quote: NYSE: ONON. Day's Open. $ Volume. 5,, Intraday. Use the tabs to find data on Price, Performance over a variety of time periods, Technical analysis summaries and key Fundamental information. During earnings. Yahoo Finance Screeners lets you choose from hundreds of data filters to discover Stocks, Mutual Funds, ETFs and more. Year End Stock Prices The historical stock information provided is for informational purposes only and is not intended for trading purposes. The historical. U.S. STOCKS ; Nasdaq Composite, , ; S&P , , ; DJ Total Stock Market, , ; Russell , ,

The chart shows company stock prices from begin year to present. The Look Up. Stock Quote: NYSE: ONON. Day's Open. $ Volume. 5,, Intraday. Stock Screener · Price · Change % · Volume · Rel Volume · Market cap · P/E · EPS dil · EPS dil growth. Stock quote & chart, historical price lookup, investment calculator, fundamentals, analyst coverage, financial info, financial reports, SEC filings, quarterly. Speculation that the Fed may cut interest rates by 50 bp at next week's FOMC meeting supported stocks Friday after former New York Fed President Dudley said. Historic Stock Lookup · Week of September 9, · Year End Stock Prices. Access unique analysis and commentary on earnings data for S&P companies Stock Quote & Chart Historic Price Lookup Investment Calculator Dividends &. Check your network connection. Click a stock in the list, or to search for a stock, type its company name or stock symbol in the search field. When the. Up-to-date stock market data coverage from CNN. Get US consumers are feeling more positive about prices, with expectations for inflation rates in the. Stock screener for investors and traders, financial visualizations. Updated world stock indexes. Get an overview of major world indexes, current values and stock market data. Get a stock quote. Just enter in a stock or mutual fund symbol to get timely stock and mutual fund price quotes from the S&P , NYSE, NASDAQ and the Dow. Stock quote & chart, historic price lookup, investment calculator, dividends & splits, analyst coverage, consensus financials, quarterly results, SEC filings. To see all of the fields available for a company or fund, click the stock icon (Linked record icon for Stock) or select the cell and press Ctrl+Shift+F5. If. To search for a specific stock, enter a ticker symbol, company name, fund name, or index in the search field at the top of the screen, then tap the symbol in. No Recent Tickers. Visit a quote page and your recently viewed tickers will be displayed here. Search Tickers. See the stock price and the historical stock price for Texas Instrument. Search for stocks and share prices, company fundamentals, news and trading information for all instruments traded on the London Stock Exchange's markets via. Syntax · ticker - The ticker symbol for the security to consider. · attribute - [ OPTIONAL - "price" by default ] - The attribute to fetch about ticker from. Stock Data · · Stock Chart · Historical Price Look Up · Investment Calculator · Analyst Coverage · Learn More. Online brokerage sites such as eTrade and TD Ameritrade or apps like Robinhood will have both real-time and historical quote data for customers and usually.

Stock Apps That Allow Custodial Accounts

Open an E*TRADE custodial account - a brokerage account that a child can take over at 18 or It is a great way to protect and build a child's future. Estate Account. Allow easier access to the deceased's funds, separate personal from estate assets and help reduce tax obligations. View PDF application. Custodial accounts are only offered through our Stash+ account. Once you join Stash+, we'll help walk you through the process of setting up your custodial. An UGMA or UTMA (named for the Uniform Gifts to Minors and Uniform Transfers to Minors Acts) is a custodial account that allows you to give money to a minor. Within the "Invest Module" of your child's dashboard, kids can research stocks and ETFs and request that the primary parent place buy or sell orders using their. From IRAs and investment accounts to personalized guidance, see the many ways we can help you. App Store · Empower App - EPW - Play Store · Empower App - Play. The Schwab One Custodial Account is a brokerage account that allows you to make a financial gift to a minor and help teach them about investing. Invest in a child's future while time is on their side. M1 Custodial Accounts allow you to invest on a child's behalf for any future financial needs. Basically, these are easy-to-open accounts used to invest in stocks, bonds, mutual funds, and more—all to give a child a better future. Things to consider. Open an E*TRADE custodial account - a brokerage account that a child can take over at 18 or It is a great way to protect and build a child's future. Estate Account. Allow easier access to the deceased's funds, separate personal from estate assets and help reduce tax obligations. View PDF application. Custodial accounts are only offered through our Stash+ account. Once you join Stash+, we'll help walk you through the process of setting up your custodial. An UGMA or UTMA (named for the Uniform Gifts to Minors and Uniform Transfers to Minors Acts) is a custodial account that allows you to give money to a minor. Within the "Invest Module" of your child's dashboard, kids can research stocks and ETFs and request that the primary parent place buy or sell orders using their. From IRAs and investment accounts to personalized guidance, see the many ways we can help you. App Store · Empower App - EPW - Play Store · Empower App - Play. The Schwab One Custodial Account is a brokerage account that allows you to make a financial gift to a minor and help teach them about investing. Invest in a child's future while time is on their side. M1 Custodial Accounts allow you to invest on a child's behalf for any future financial needs. Basically, these are easy-to-open accounts used to invest in stocks, bonds, mutual funds, and more—all to give a child a better future. Things to consider.

If you want to set aside money for college expenses that aren't covered by an Education Savings Account (ESA) or plan, a custodial account might help. Open a custodial account with Alliant Credit Union. Our custodial accounts for minors offer above-market dividends and enable quick transfers of assets. Looking to invest in your child's future? A custodial account may be a great option. Let's look at what they are, how to use them, the pros and cons. A mutual fund custodial account allows you to choose from a set of mutual Stock funds invest in stocks; Bond funds invest in bonds; Balanced funds. Stockpile: A popular stock gifting app that supports custodial and individual brokerage accounts. UNest: An app-based UTMA account provider that makes it easy. Custodial accounts can be used to save for the child's future, offer a financial gift, or invest in mutual funds, stocks, and bonds. Another method you may want to consider is setting up a custodial account as established by either the Uniform Gift to Minors Act (UGMA) or the Uniform. There are several cryptocurrency and stock trading platforms that allow custodial accounts. Here are a few examples: 1. Within the "Invest Module" of your child's dashboard, kids can research stocks and ETFs and request that the primary parent place buy or sell orders using their. Looking to invest in your child's future? A custodial account may be a great option. Let's look at what they are, how to use them, the pros and cons. Details of Each Custodial Brokerage Account · Charles Schwab is ideal for beginner investors and investors in search of no-minimum index funds. · E*TRADE is among. Why wait to start growing your money? Create an account today! Stash Banking services provided by Stride Bank, N.A., Member FDIC. The Stash Stock-Back® Debit. Custodial accounts allow legal guardians or custodians to create accounts for the benefit of a beneficiary (someone under 18 years old.). The two types of custodial accounts are UGMA (Uniform Gifts to Minors Act) and UTMA (Uniform Transfer to Minors Act), named after the laws that created them. Begin your child's investment future with a UGMA custodial account. Start for as little as $1/day. Open an account today in just 5 minutes! Custodial accounts help adults save and invest money on behalf of a child until the assets must be transferred to them. Learn about UGMA/UTMA accounts here. Estate Account. Allow easier access to the deceased's funds, separate personal from estate assets and help reduce tax obligations. View PDF application. Buy, sell, and trade stocks online with a brokerage account from Wells Fargo Advisors WellsTrade. You have options when it comes to investing for a child or a minor. Learn more about what Vanguard UGMA/UTMA custodial accounts have to offer. Custodial accounts can be used to save for the child's future, offer a financial gift, or invest in mutual funds, stocks, and bonds.

Best Way To Send Money Internationally Without Fees

One of the safest and approved way to transfer money internationally is through Swift transfer through banks. The other options are Xoom. International Wire Transfer Features. Wires Icon. $0 outbound wire transfer fee if sent in foreign currency. Wise is one of the cheapest solutions for just transferring without converting, this would be a same-currency transfer for which Wise will use. Transfer money online securely and easily with Xoom and save on money transfer fees. Wire money to a bank account in minutes or pick up cash at thousands of. The Xe app has everything you need for international money transfers. It's easy, secure, and has no surprise fees. Download the app. xe mobile app mockup. How to transfer money internationally? · Create an account This is simple. · We'll verify your details For even better security, we'll verify who you are. · Start. Find the cheapest ways to transfer money internationally · Bank transfer. We charge a small fee for international bank transfers, depending on the currency and. Know what methods to use — and which ones to avoid — can help you save money when you need to send money internationally. Regular transfers to one place – free transfers via banks A number of banks allow you to transfer money to linked banks overseas without a fee – though. One of the safest and approved way to transfer money internationally is through Swift transfer through banks. The other options are Xoom. International Wire Transfer Features. Wires Icon. $0 outbound wire transfer fee if sent in foreign currency. Wise is one of the cheapest solutions for just transferring without converting, this would be a same-currency transfer for which Wise will use. Transfer money online securely and easily with Xoom and save on money transfer fees. Wire money to a bank account in minutes or pick up cash at thousands of. The Xe app has everything you need for international money transfers. It's easy, secure, and has no surprise fees. Download the app. xe mobile app mockup. How to transfer money internationally? · Create an account This is simple. · We'll verify your details For even better security, we'll verify who you are. · Start. Find the cheapest ways to transfer money internationally · Bank transfer. We charge a small fee for international bank transfers, depending on the currency and. Know what methods to use — and which ones to avoid — can help you save money when you need to send money internationally. Regular transfers to one place – free transfers via banks A number of banks allow you to transfer money to linked banks overseas without a fee – though.

Send money to family and friends abroad with the Remitly app, and get a special offer on your first transfer! Trusted by millions worldwide, the Remitly app. To transfer money internationally via Xoom in the PayPal app, go to the App menu and choose your preferred delivery option. How long do money transfers take? When you send money overseas using NetBank or the CommBank app, we'll waive the transfer fee (excludes AUD to AUD). We'll also absorb correspondent bank fees. With millions of downloads, the MoneyGram money transfer app is an easy way to send money internationally with great foreign exchange rates. Now, iOS users. New apps like PayPal and Zelle make it easy to send money to friends and family in a matter of minutes, with no fees. Western Union and MoneyGram can be used to. Send money with $0 transfer fees and competitive exchange rates to keep overall costs low. Checkmark. Quickly Delivered Globally: Most payments are received. You may send money to people or businesses in countries that have agreements with USPS®. Learn about how much it costs to send an international money order, the. Another great option to avoid high bank fees is TransferWise. While many banks offer competitive fees, they typically offer poor exchange rates. If you also. An economical, convenient and dependable way to send money home®. Extensive With ExpressSend you save with low transfer fees and competitive rates. HSBC Global Money Transfers lets you send money overseas faster and fee-free, with just a few taps on the HSBC Mobile Banking app. Looking for the cheapest way to transfer money internationally? See the best tips and providers for transferring money to a foreign currency in Transfer money with no fee to bank accounts in certain countries by sending from your own account. You can always find out how much it costs to send money. You can send thousands of dollars at once and convert the funds to foreign currency as needed. What is Needed for an International Wire Transfer? The. Wire transfers are a quick way to send money domestically or internationally. While you can do both in Mobile Banking and Online Banking, this guided demo. To find the best way to transfer money internationally, it's important to understand the fees, exchange rates, and speed of different transfer options. Bank draft, wire transfer, money order or online remittance – for the occasional transfer, you might not be fussy with how you send your money. There are many. Join the millions of people who have trusted Remitly since to send money to friends and family overseas. More money makes it home to loved ones with. Enjoy unlimited international money transfers with transfer fees rebated for up to 12 months when you send money using TD Global TransferTM Conditions apply. This could be through a local bank or a money transfer provider. Knowing how they want to receive the funds will help the transaction. After all, they're in a. The best ways to send money abroad with Revolut · Revolut-to-Revolut transfer. Send money to other Revolut friends in 36 currencies — instantly and without.

What Is Lvr

The LVR will help determine whether your home loan needs to be covered by Lenders' Mortgage Insurance (LMI) or a Low Deposit Premium (LDP). We will require you. Loan to value ratio LVR calculator · 5% deposit equates to 95% LVR · 10% deposit equates to 90% LVR · 15% deposit equates to 85% LVR · 20% deposit equates to LVR shows the ratio of the value of your property to the size of your loan as a percentage. Banks commonly use LVR to assess the risk of a loan, with a higher. Definition of LVR (loan to value ratio) to help with your property investing. Lead velocity rate (LVR) is a measure of the growth percentage change of qualified leads from month to month. Note that a qualified lead (also known as a. LVR recap · LVR is a percentage showing the ratio of your borrowing amount to the value of the property you're buying. · You can calculate the LVR on a property. Loan to Value Ratio (LVR) is the size of your loan compared to the property purchase price. Learn how your LVR will impact your home loan process. Generally, an LVR of 60% or less means you will be able to access the best interest rate on your home loan. From the lender's perspective, a lower LVR means a. Your Loan-To-Value Ratio (LVR) is the amount of your home loan represented as a percentage of the value of the property. Find out how it can affect your. The LVR will help determine whether your home loan needs to be covered by Lenders' Mortgage Insurance (LMI) or a Low Deposit Premium (LDP). We will require you. Loan to value ratio LVR calculator · 5% deposit equates to 95% LVR · 10% deposit equates to 90% LVR · 15% deposit equates to 85% LVR · 20% deposit equates to LVR shows the ratio of the value of your property to the size of your loan as a percentage. Banks commonly use LVR to assess the risk of a loan, with a higher. Definition of LVR (loan to value ratio) to help with your property investing. Lead velocity rate (LVR) is a measure of the growth percentage change of qualified leads from month to month. Note that a qualified lead (also known as a. LVR recap · LVR is a percentage showing the ratio of your borrowing amount to the value of the property you're buying. · You can calculate the LVR on a property. Loan to Value Ratio (LVR) is the size of your loan compared to the property purchase price. Learn how your LVR will impact your home loan process. Generally, an LVR of 60% or less means you will be able to access the best interest rate on your home loan. From the lender's perspective, a lower LVR means a. Your Loan-To-Value Ratio (LVR) is the amount of your home loan represented as a percentage of the value of the property. Find out how it can affect your.

More videos on YouTube Loan to value ratios are a metric commonly used by lenders to determine how much money they are willing to loan to a borrower. LVR is. Loan to value ratio (LVR) is calculated on your deposit amount and the property's value. Read on to see how it affects how much you can borrow. How is Loan to Value Ratio (LVR) calculated? LVR is calculated by dividing your loan amount by the value of the property, then multiplying by For example. The Loan-to-Value Ratio (LVR) is the ratio of your loan amount to the property's appraised value. It significantly influences your borrowing capacity and the. Loan to Value Ratio (LVR) is calculated by dividing the loan amount by the lender-assessed value of the property. Generally speaking, most lenders. What is LVR, and why it is important for investors? LVR or loan-to-valuation ratio is the proportion of money you borrow (loan) compared to the value of the. What does LVR mean? As you delve into the world of loans and mortgages, you may come across the abbreviation 'LVR'. LVR stands for Loan-to-Value Ratio. The LVR. Whether a bank will use the purchase price or a bank valuation to calculate your LVR depends on the circumstances of your loan. Some banks will use the. Some lenders have a maximum LVR of 90%. This means you would need at least a 10% deposit to be eligible for a home loan. Read Transcript · LVR stands for loan to value ratio. · For example, if you are buying a $k house and you have a 20% deposit, which is $k, the LVR is 80%. Loan to value ratio (LVR) Your LVR can help you determine whether you're likely to get approved for a home loan, and it can even affect how much you'll be. The term LVR stands for 'loan to value ratio'. It shows the value of your home loan as a percentage of the property's value. The LVR formula is calculated by. What is an LVR? A loan-to-value ratio (LVR) is the measurement of the size of your loan in comparison to the value of your property. For example, if your. What is LVR and why is it important? Banks need a buffer to safeguard their investments when they lend money to home buyers. That buffer is your home deposit. To calculate LVR, you divide the loan amount by the property's value and then multiply the result by to get a percentage. This formula gives you a clear. Why does LVR Matter? LVR affects your borrowing power as lenders use LVR to determine how much they can lend against a property. If you have an LVR of more than. In the simplest terms, the LVR is the percentage of the property's value, as assessed by the lender, that your loan equates to. So, if the property you want to. Lenders generally consider loans with a Loan to Value Ratio over 80% of the property value to be high risk. Hence why any loan that is over 80% LVR or higher. Loan to Value Ratio (LVR) is a term you will come across when applying for a home loan. It is the ratio of the loan amount against the value of the property you. LVR is a term that is used a lot when it comes to finance. LVR is the Loan to Value Ratio. This ratio is used by lenders when determining how much you can.